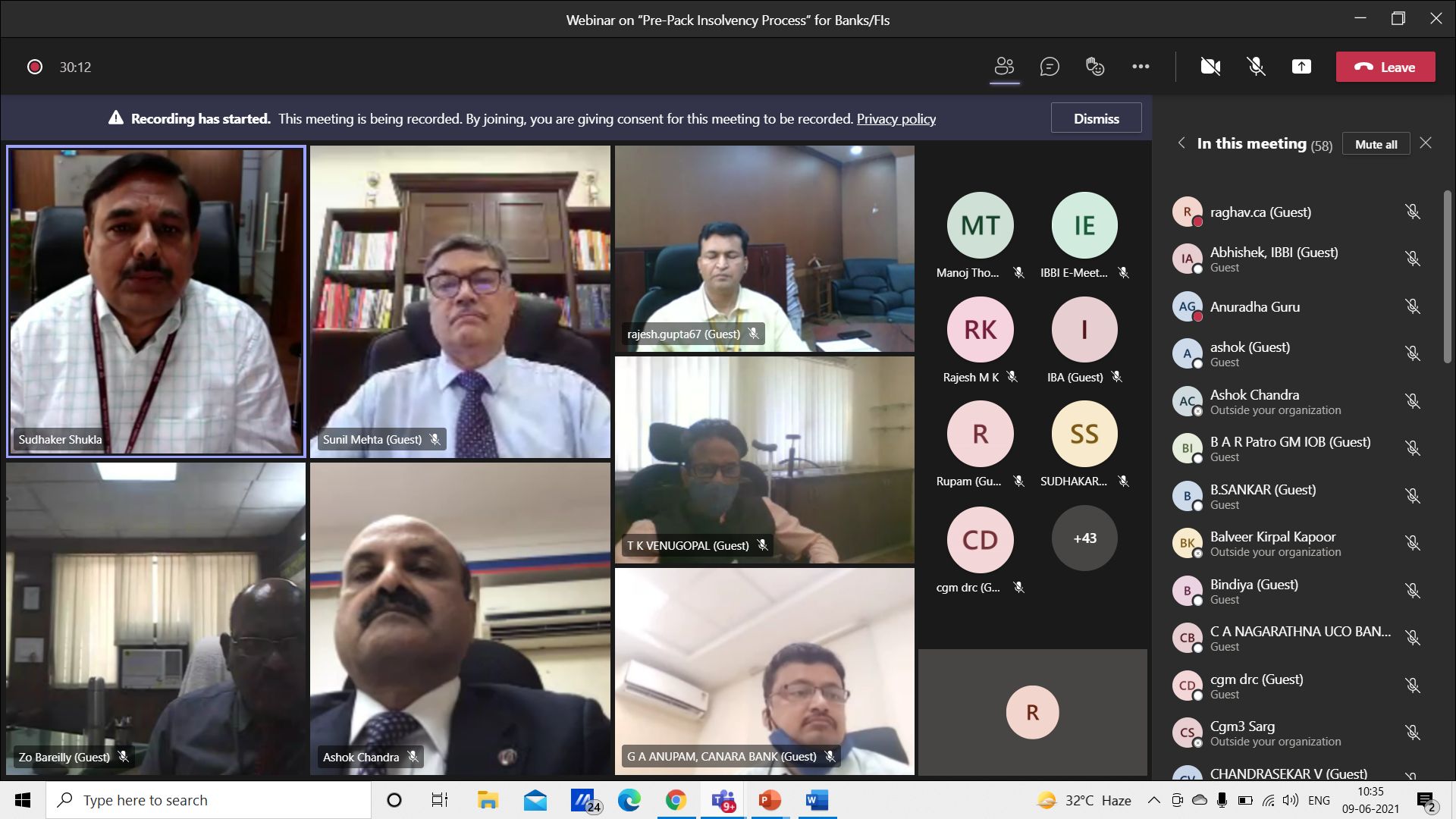

The Insolvency and Bankruptcy Board of India (IBBI), in association with the Indian Banks’ Association (IBA), organised a webinar on “Prepackaged insolvency resolution process for MSMEs”, today. The webinar was organized for senior officers of member banks of IBA, to discuss the rationale, implications and implementation of the provisions of “The Insolvency and Bankruptcy Code (Amendment) Ordinance, 2021”, which introduced the prepackaged insolvency resolution framework for corporate MSMEs. Queries raised by the participants regarding this new resolution process were also addressed during the webinar. Fifty, middle and senior management officers (Deputy General Manager and above) representing twenty scheduled commercial banks and financial institutions participated in the Webinar. Shri Sudhaker Shukla, Whole Time Member, IBBI delivered the inaugural address at the Webinar. He presented the rationale for the Ordinance and mentioned the unique features of the pre-pack framework. The new dispensation has set yet another milestone in the evolving insolvency law in the country, he added. Mr. Sunil Mehta, Chief Executive, IBA while welcoming the participants appreciated the putting in place of this framework in accordance with the need of the present times characterised by increased stress in the MSME sector in the wake of the ongoing COVID-19 pandemic. The eminent faculty at the webinar included Mr. Ashish Makhija, Insolvency Professional; Mr. Venkataraman Subramanian, Chief General Manager, SBI; Mr. Ritesh Kavdia, Executive Director, IBBI; Mr. Rajesh Kumar Gupta, Chief General Manager, IBBI; and Ms. (Dr.) Kokila Jayaram, Deputy General Manager, IBBI.