Page 17 - IBBI

P. 17

INSOLVENCY AND BANKRUPTCY NEWS

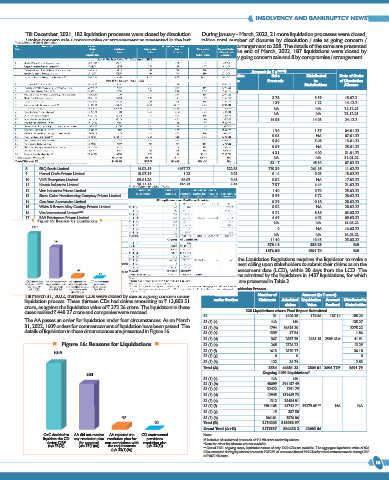

Till December, 2021, 182 liquidation processes were closed by dissolution During January - March, 2022, 21 more liquidation processes were closed,

/ going concern sale / compromise or arrangement as presented in the last taking total number of closures by dissolution / sale as going concern /

newsletter. Dissolution / going concern sale / compromise or arrangement compromise or arrangement to 208. The details of the same are presented

of ve more CDs, which happened during the earlier period were in Table 2. At the end of March, 2022, 187 liquidations were closed by

reported later, as presented in Part A of Table 2. dissolution, 13 by going concern sale and 8 by compromise / arrangement.

Table 2: Details of Closed Liquidations

Sl. Name of CD Date of Amount (in ` crore)

No. Order Admitted Liquidation Sale Distributed Date of Order

of Claims Value Proceeds to of Dissolution

Liquidation Stakeholders /Closure

Part A: For Prior Period (Till December 31, 2021)

1 Shashi Oils and Fats Private Limited 21-01-20 49.71 3.13 3.78 3.59 15-07-21

2 Raipur Polymers Private Limited*** 10-08-21 8.74 0.98 1.39 1.22 14-12-21

3 Mahendrakumar Babulal Jewels Private Limited 17-09-19 24.19 NA NA NA 21-12-21

4 Sunder Agromills Private Limited* 23-12-21 22.27 NA NA NA 23-12-21

5 Kansal Building Solutions Private Limited** 06-02-20 26.49 13.00 14.08 14.03 24-12-21

Part B: For January - March, 2022

1 J.R.Diamond Private Limited 01-10-18 10.41 1.23 1.90 1.57 04-01-22

2 Pradeep Downhole Equipments Private Limited 20-09-19 0.67 0.03 0.03 NA 07-01-22

3 Nazar International Pvt. Ltd.*** 20-07-21 42.76 4.88 5.50 5.08 13-01-22

4 Ada Cellworks Wireless Engineering Private Limited 18-02-20 1.33 0.15 0.09 NA 25-01-22

5 Sheth Metal Private Limited 07-01-19 148.24 2.93 4.31 4.00 31-01-22

6 Diabari Tea Co Ltd 11-03-20 76.90 NA NA NA 31-01-22

7 Servomax India Private Limited*** 04-02-19 794.15 30.96 53.17 48.30 07-02-22

8 SBQ Steels Limited 14-02-19 4697.27 322.85 270.39 261.38 11-02-22

9 Marvel Crafts Private Limited 15-07-19 1.23 0.03 0.14 0.03 15-02-22

10 VHR Enterprises Limited 09-01-20 86.02 0.45 0.02 NA 17-02-22

11 Noesis Industries Limited 28-11-19 580.15 6.85 7.57 6.44 21-02-22

12 Vast Industries Private Limited 15-12-20 9.81 1.24 1.40 0.70 25-02-22

13 Shree Coke Manufacturing Company Private Limited 20-07-18 67.58 5.73 5.99 5.72 28-02-22

14 Goa Auto Accessories Limited 20-08-19 14.62 0.26 0.29 0.18 28-02-22

15 White & Brown Alloy Castings Private Limited 26-08-19 17.29 0.02 0.02 NA 28-02-22

16 Visa international Limited*** 11-05-21 8143.17 8.82 9.22 8.38 03-03-22

17 BIW Fabricators Private Limited 22-11-19 32.92 7.56 6.69 6.02 09-03-22

18 Nova Steels (India) Limited 10-08-21 0.09 NA NA NA 15-03-22

19 Shree Saibaba Ispat (India) Private Limited 11-11-20 0.12 0 0 NA 16-03-22

20 Windsor Papers Private Limited 16-02-21 0.01 NA NA NA 16-03-22

21 Bhaskar Shrachi Alloys Ltd*** 29-04-20 196.30 7.29 11.40 10.43 23-03-22

Total (January - March, 22) 14921.04 401.28 378.13 358.23 NA

Total (Till March, 22) 49161.99 1935.75 1876.08 1801.74 NA

Note:

* Direct Dissolution; Claims pertain to CIRP period. Regulation 12 of the Liquidation Regulations requires the liquidator to make a

** Compromise or arrangement under section 230 of the Companies Act, 2013. public announcement calling upon stakeholders to submit their claims as on the

*** Sale as a going concern liquidation commencement date (LCD), within 30 days from the LCD. The

NA means Not realisable/ saleable or No asset left for liquidation or Not applicable.

‘0’ means an amount below two decimals. details of the claims admitted by the liquidators in 1437 liquidations, for which

data are available, are presented in Table 3.

Sale as Going Concern Table 3: Claims in Liquidation Process

Till March 31, 2022, thirteen CDs were closed by sale as a going concern under Stakeholders Number of Amount (in ` crore)

liquidation process. These thirteen CDs had claims amounting to ` 13,803.51 under Section Claimants Admitted Liquidation Amount Distributed to

Value

Realised Stakeholder

claims

crore, as against the liquidation value of ` 372.26 crore. The liquidators in these 328 Liquidations where Final Report Submitted

cases realised ` 448.27 crore and companies were rescued.

52 31 1408.38 178.86 187.14 185.23

The AA passes an order for liquidation under four circumstances. As on March 53 (1) (a) NA NA 135.27

31, 2022, 1609 orders for commencement of liquidation have been passed. The 53 (1) (b) 1794 56693.30 2275.22

details of liquidation in these circumstances are presented in Figure 16. 53 (1) (c) 1339 57.84 1.86

53 (1) (d) 367 2887.98 2625.15 2509.63# 41.91

Figure 16: Reasons for Liquidations 53 (1) (e) 268 2726.22 13.29

53 (1) (f) 1613 2570.77 36.18

1019

53 (1) (g) 0 0 0

53 (1) (h) 122 36.74 2.83

Total (A) 5534 66381.23 2804.01 2696.77# 2691.79

533 Ongoing 1109 Liquidations*

53 (1) (a) NA NA

53 (1) (b) 40099 594157.49

53 (1) (c) 32422 1291.79

53 (1) (d) 12945 139469.73

53 (1) (e) 1312 35454.81

53 (1) (f) 1981105 43742.71 39279.05 ** NA NA

53 (1) (g) 19 357.58

47 53 (1) (h) 106101 3576.86

10 Total (B) 2174003 818050.97

Grand Total (A+B) 2179537 884432.2 42083.06

CoC decided to AA did not receive AA rejected the CD contravened Note:

liquidate the CD any resolution plan resolution plan for provisions # Inclusive of unclaimed proceeds of ₹ 4.98 crore under liquidation.

during CIRP for approval non-complaince with resolution plan *Data for other liquidations are not available.

(u/s 33(2)) (u/s 33(1)(a)) the requirements (u/s 33(3)) **Out of 1281 ongoing cases, liquidation values of only 1220 CDs are available. The aggregate liquidation value of 826

(u/s 33(1)(b)) CDs estimated during liquidation process is ` 39279.05 crore and that of 394 CDs for which estimates made during CIRP

is ` 9070.95 crore.

16